Competing in the Age of AI

How Legacy Companies Integrate AI-First Acquisitions

1. The New Playbook for AI M&A

When an established brand buys an AI-first start-up, the deal is rarely about headline‐grabbing valuations. It is about compressing years of data-science hiring, model training, and product learning curves into a single leap. That leap only pays off if the acquirer can weave the new algorithms, data pipelines, and talent into its core products before competitors close the gap.

2. Five Integrations That Moved the Needle

Nike acquisition of Celect (predictive analytics, 2019)

Integration Focus: Hyper-local demand predictions to cut stock-outs and overstock

Notable Results: Celect models shrank inventory-planning windows from six months to 30 minutes, supporting Nike’s “Consumer Direct Offense” strategy.

Salesforce acquisition of MetaMind (deep-learning NLP & vision, 2016) plus other AI buys

Integration Focus: Einstein AI layer embedded across Sales, Service, Marketing and Commerce Clouds

Notable Results: Einstein now delivers >80 billion AI predictions a day and powers opportunity scoring, chatbots and image recognition inside core CRM workflows.

McDonald's acquisition of Dynamic Yield (personalisation, 2019) + Apprente (voice, 2019)

Mastercard acquisition of Brighterion (fraud AI, 2017)

Integration Focus: Smart-agent ML models scoring every card transaction in real time

Notable Results: Combined network data and Brighterion’s technology cut false positives and improved fraud detection accuracy across 150 billion annual transactions.

Microsoft acquisition of Nuance (speech & clinical AI, closed 2022)

Integration Focus: Ambient clinical intelligence (DAX) integrated into Teams and Azure Health

Notable Results: DAX auto-generates EHR notes during telehealth visits, attacking clinician burnout while expanding Microsoft’s healthcare cloud TAM by ~$500 billion.

3. Common Challenges Encountered

Data labyrinths – AI models starve without unified, high-quality data. Each case above required massive data plumbing before models could generalise across the acquirer’s global footprint. McDonald’s had to align menu, traffic and weather feeds in near-real time while Nike merged RFID store signals with Celect demand graphs.

Culture and talent retention – Startup innovators resist slow release cycles; legacy teams distrust “black-box” outputs. Salesforce created a dedicated Einstein Research group of 175 data scientists reporting to MetaMind’s founder to safeguard velocity.

Ethics, privacy and bias – PCI, HIPAA and regional AI regulations force new governance boards (e.g., Microsoft’s Responsible AI committee overseeing Nuance data flows).

Measuring ROI beyond a pilot – Early pilots often raise expectations faster than revenue. For example, while the introduction of Dynamic Yield had a positive revenue impact for McDonald's initially, franchisees complained that Dynamic Yield’s uplift was uneven, prompting McDonald’s to sell a majority stake to Mastercard after three years.

Change management in the field – Store managers, call-center agents or treasury analysts must trust the algorithm before they act on it. Nike rolled out small “inventory wins” to frontline merchandisers first, then scaled enterprise-wide.

4. Tips for a Successful Integration

Start with user journeys, not feature parity. A purely “gap analysis” misses the emotional and workflow frictions that sabotage adoption. In the GTreasury & CashAnalytics merger, a user-centred discovery uncovered hidden pain points and produced a roadmap the combined teams could rally around.

Ship thin slices that prove value quickly. McDonald’s chose drive-thru suggestive selling—visible ROI within weeks—before tackling kitchen forecasting. Prioritise use-cases where data quality is highest and latency constraints are manageable.

Synchronise data infrastructure early. Create shared schemas, streaming pipelines and unified feature stores before model training. Nike’s RFID rollout ran in lock-step with Celect’s demand algorithms to avoid “garbage-in” forecasts.

Pair cross-functional squads. Blend legacy domain experts with acquired data scientists in one backlog, one OKR set, one release cadence. Salesforce embedded Einstein APIs directly inside the Lightning platform, so product managers and ML engineers shipped together.

Retain and empower AI talent. Keep founders visible (e.g., MetaMind’s Richard Socher became Salesforce Chief Scientist) and give teams autonomy over model evolution, tooling and open-source contributions.

Build ethical guardrails. Stand up model governance, bias testing and incident response processes that match the acquirer’s brand trust level—especially in finance and healthcare. Mastercard credits its “Smart Agent” explainability for regulator confidence.

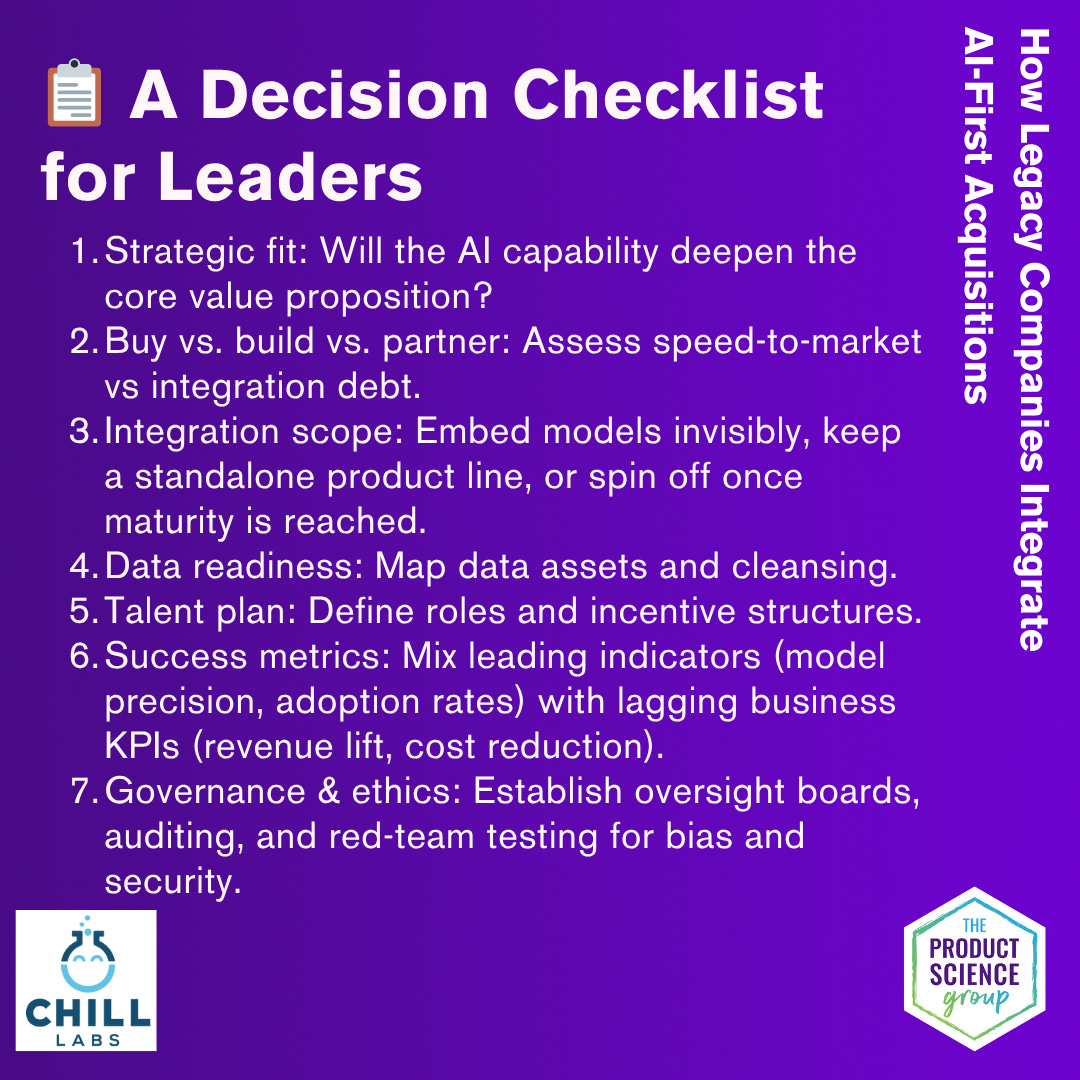

5. A Decision Checklist for Leaders

Strategic fit: Will the AI capability deepen the core value proposition or distract from it?

Buy vs. build vs. partner: Assess speed-to-market advantage against integration debt.

Integration scope: Embed models invisibly (Salesforce), keep a standalone product line (Mastercard), or spin off once maturity is reached (McDonald’s sale to Mastercard).

Data readiness: Map required data assets, ownership, privacy constraints and cleansing effort.

Talent plan: Define roles, career paths and incentive structures for acquired staff.

Success metrics: Mix leading indicators (model precision, adoption rates) with lagging business KPIs (revenue lift, cost reduction).

Governance & ethics: Establish oversight boards, auditing, and red-team testing for bias and security.

6. Bottom Line

AI acquisitions succeed when legacy giants respect the startup’s speed and wrap that speed in the acquirer’s scale, data, and distribution. Put real users at the center, wire the data first, and guard culture as carefully as code. The companies above show that when those pieces click, a century-old burger chain, a shoemaker, a payments network, and an enterprise cloud titan can successfully integrate AI into their product ecosystem.

Dina Levitan is Principal Product Managment Consultant at Product Science Group and Founder at Chill Labs. Check out Chill Labs at chillaborate.com